- AlphaPacked — Daily Crypto Newsletter

- Posts

- Stream Finance Discloses $93M Loss

Stream Finance Discloses $93M Loss

PLUS: MegaETH to reveal pubic sale allocations; Monad reveals mainnet date.

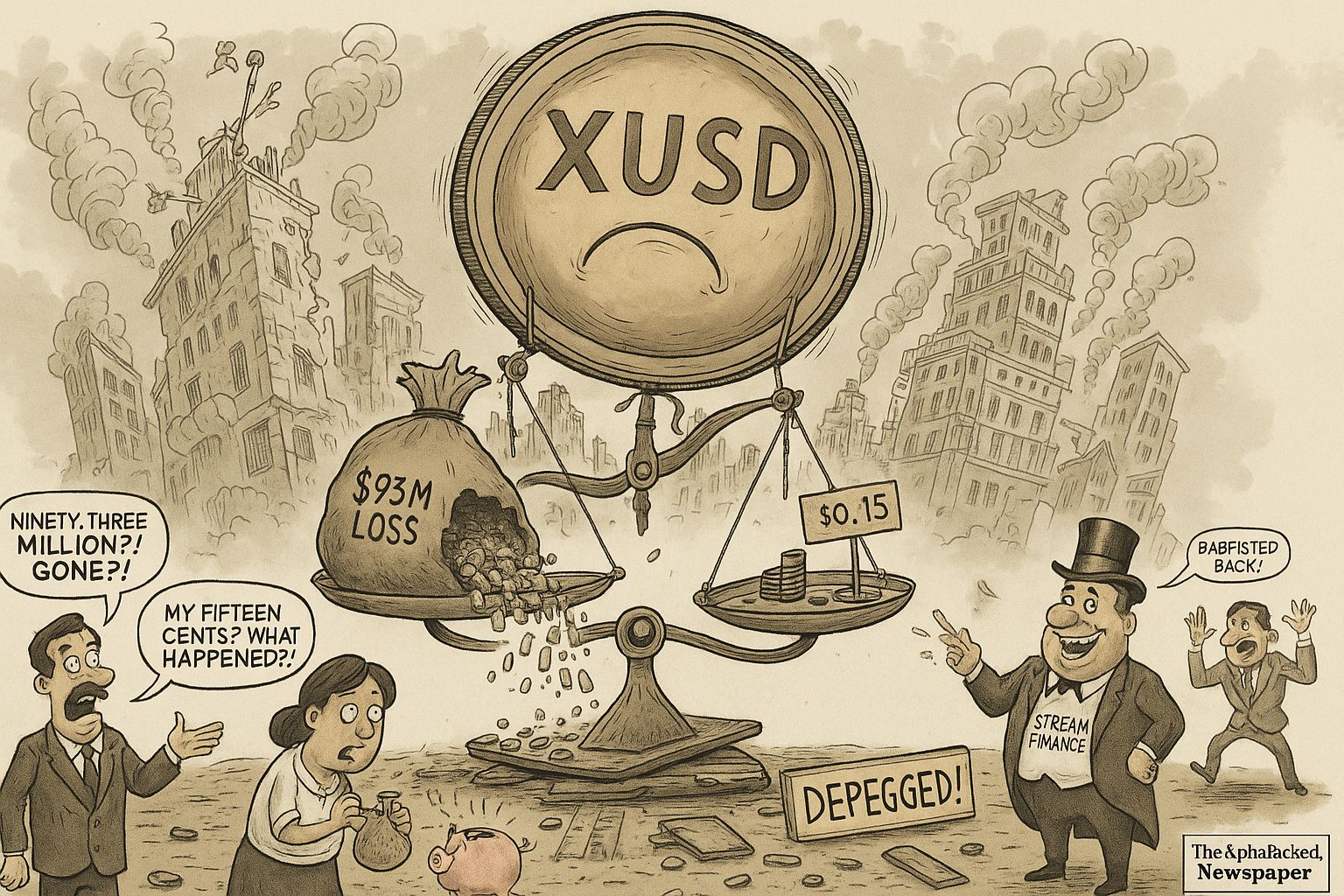

📉 Stream Finance Reports $93M Asset Loss

Loss and Immediate Response: On Monday, Stream Finance announced a $93 million loss in managed assets due to liquidity mismatches and collateral devaluation in synthetic assets (xUSD, xBTC, xETH), disclosed by an external fund manager. Withdrawals and deposits were suspended immediately. Stream stated, “Until we are able to fully assess the scope and causes of the loss, all withdrawals and deposits will be temporarily suspended.” Pending deposits remain unprocessed. The team plans to withdraw remaining liquid assets and has engaged lawyers Keith Miller and Joseph Cutler from Perkins Coie LLP for investigation.

DeFi Exposure Analysis: Analysts identified $285 million in Stream-related debt across seven networks, excluding indirect exposures. Key counterparties include Elixir ($68 million, 65% of deUSD backing), TelosC ($123.6 million), and MEV Capital ($25.4 million). Assets were rehypothecated in protocols such as Euler, Silo, Morpho, and Sonic. By Tuesday at 00:50 a.m. ET, xUSD had fallen to $0.53 from its $1 peg, with recent reports indicating a further decline to $0.16. Elixir maintains full $1 redemption rights but has paused repayments pending legal review.

Ongoing Risks and Updates: YAM analyst noted, “This is a massive loss... There likely are more stables and vaults affected.” They added, “We expect more affected vaults to emerge as positions unwind and lending contracts are audited.” Stream committed to providing periodic updates during the assessment. The incident exposed vulnerabilities in rehypothecated assets across DeFi protocols, with community speculation pointing to risky investments by curators such as Re7 Labs and Telos Consilium. Read More.

️ On today's Top Picks:

️ On today's Top Picks:

- 💸 Ripple $XRP raises $500M at $40B valuation in Strategic funding.

- 👀 MegaETH to reveal $MEGA pubic sale allocations on Nov 6th.

- 🟣 Monad $MON to launch mainnet, TGE, & airdrop on Nov 24th.

- 🕵️ Balancer publishes preliminary report regarding ~$116M hack.

Read time: ⏰ 7 minutes

Crypto News

Crypto News

• ⭐️ Stream Finance discloses $93M loss by external fund manager; suspends withdrawals & deposits; hires Perkins Coie law firm to investigate; $XUSD has since depegged to ~$0.15.

• US SEC probe into crypto treasury firms frozen by ongoing government shutdown; to potentially issue subpoenas once the government reopens.

• ⭐️ Ripple $XRP raises $500M at $40B valuation in Strategic funding led by Fortress Investment Group & Citadel Securities; also supported by Pantera Capital, Galaxy Digital $GLXY, Brevan Howard, & Marshall Wace.

• Ripple $XRP collaborates with Mastercard $MA, WebBank, & Gemini to introduce $RLUSD settlement on the XRP Ledger for fiat credit card payments.

• ZKsync $ZK founder Alex Gluchowski proposes new ZK tokenomics; proposes economic utility with 'onchain interop fees' & 'offchain enterprise licensing'.

• Gemini to reportedly launch prediction market contracts; recently applied to the US CFTC for approval to operate a designated contract market (DCM).

• Zama acquires Kakarot for an undisclosed amount; Zama to launch mainnet soon.

Alpha

Alpha

• ⭐️ MegaETH to reveal $MEGA pubic sale allocations on November 6th; ~50K bidders committed ~$1.39B.

• Base announces Base Batches 002 finalists; the 50 finalists to present at Demo Day at Ethereum Devconnect.

• Stable to launch Phase 2 of Pre-Deposit Campaign on November 6th; requires KYC & capped at $500M; Stable recently launched its Public Testnet.

• Coinbase $COIN to launch Coinbase One Member Week on November 10th; features five days of rewards, boosts, & early access drops.

• Rainbow to launch new collectible app icon; app icons to potentially be a criteria/multiplier for upcoming $RNBW airdrop.

• Jumper launches Jumper Pass X account; launches Jumper Pass Party campaign; complete 1-4 missions to earn XP & rewards.

• EtherScore launches Jumper Pass Verified; level 15+ Jumper Pass holders are eligible.

Airdrops

Airdrops

• ⭐️ Monad $MON to launch mainnet, TGE, & airdrop on November 24th; eligible users can view allocations on the airdrop portal.

• Intuition launches $TRUST airdrop claim; IQ points holders, high-signal Ethereum users, & more were eligible to register.

• Espresso announces two more paths to $ESP airdrop eligibility; Hyperlane $HYPER power users & AltLayer $ALT stakers to be eligible.

• Socket posts "▓▓▓▓▓▓▓▓▓▓▓▓▓▓░░░░░░ 73%" on X; to potentially launch mainnet, TGE, & airdrop soon.

• ICYMI Fogo teases "Something in November" on X; to potentially launch mainnet, TGE, & airdrop in November.

Finance News

Finance News

• US Supreme Court begins oral hearings today concerning the legality of President Trump's tariffs; ruling expected in weeks to months.

• Robinhood $HOOD reports Q3 2025 earnings; reports net revenue of $1.27B, EPS of $0.61, crypto revenue of $268M, & more.

• Metaplanet $3350.T borrows $100M to buy more Bitcoin $BTC & for share buybacks; currently holds 30,823 BTC (~$3.2B).

• Future raises CHF 28M (~$35M) to build Bitcoin $BTC treasury company; backed by Fulgur Ventures, Nakamoto, & TOBAM.

• Forward Industries $FORD approves share buyback plan for up to $1B; currently holds ~6.82M Solana $SOL (~$1.1B).

• Solana Company $HSDT approves share buyback plan for up to $100M; currently holds ~2.3M Solana $SOL (~$374M).

• Canaan $CAN raises $72M in Strategic funding from Brevan Howard Digital, Galaxy Digital $GLXY, & Weiss Asset Management.

• Ark Invest $ARKK $ARKW $ARKF buys 238K shares (~$12M) of Bullish $BLSH; also bought ~$5M worth of shares last week.

Security and Exploits

Security and Exploits

• ⭐️ Balancer $BAL publishes preliminary incident report regarding recent ~$116M hack; reveals exploit originates from rounding logic bug.

• DWF reportedly compromised in 2022 for ~$44M+ by DPRK-affiliated threat actor AppleJeus; DWF has not publicly confirmed any incident.

• ZachXBT to now support the $BNB Chain community; to publish an investigation into an exploit soon.

• MetaMask investigates & finds users who used exploits to quickly earn MetaMask Rewards points; MetaMask has since patched the exploit & removed points from exploiters.

• Apriori $APR reportedly distributes 80% of airdrop to sybil; a single clustered group of 5,800+ wallets claimed the tokens on BNB Chain.

• Moonwell exploited for ~$3.7M due to oracle malfunction; same attacker exploited Moonwell on October 10th.

• Chainalysis joins National Elder Fraud Coordination Center (NEFCC); to contribute blockchain intelligence to help law enforcement.

Token Unlocks

Token Unlocks

• Ethena $ENA / ~$55M / NOV 05th

• Linea $LINEA / ~$35M / NOV 10th

• Aptos $APT / ~$30M / NOV 11th

Sourced from Tokenomist

Funding

Funding

• CMT Digital raises $136M for fourth crypto VC fund.

• Harmonic raises $6M in Seed funding led by Paradigm.

• Zynk raises $5M in Seed funding led by Hivemind.

The Degen Farmer

The Degen Farmer

Top stablecoin yield farms of the day, more than $3,000,000 in TVL. DYOR and step up your farming game!

| PROTOCOL | ASSETS | APY |

|---|---|---|

| USDT | 3580.92% | |

| CTSTABLEUSDT | 298.16% | |

| USD1USDC | 79.94% | |

| USDC | 42.21% | |

| USD1USDTUSDC | 36.55% | |

| LVUSDTUSDT | 34.20% | |

| REUSDC | 30.41% | |

| IUSD | 24.67% |

☁️ EigenCloud: Verifiable Cloud & Ethereum Restaking |  |

☁️ What is EigenCloud EigenCloud is a developer platform built on EigenLayer, Ethereum’s leading restaking protocol. Users restake ETH or EIGEN to secure DeFi, AI, and real-world applications. With over $20B in TVL and 162+ Actively Validated Services (AVSs) in development, it’s backed by a16z’s recent $170M investment. Join now: Restake to earn rewards (over $128M already distributed) or run nodes for AI inference and scaling. Just launched: Concrete’s Staked Eigen Vault delivers 8-10% real USD yield, Eigen incentives, partner rewards, and full DeFi composability.

📊 a16z State of Crypto 2025 Report In its latest State of Crypto report, a16z highlights the convergence of global infrastructure scaling, institutional adoption, and AI’s need for verifiable compute. EigenLayer now holds 10% of all DeFi TVL, more than any chain outside Ethereum. EigenCloud stands out as the full-stack solution for trusted AI agents, offering secure inference, compute, and data availability with deep liquidity and economic security. This makes restaking a foundational layer for agentic finance and autonomous systems.

🚀 EIGEN & x402: Early in the Stack Long before x402 became the standard for agent-to-agent (A2A) payments, EigenCloud shipped live verifiable workflows with Google’s AP2 in September. EigenCompute executes tasks with cryptographic proofs, EigenDA provides scalable storage for inputs and outputs across chains, and AVSs integrate trust directly into agent operations. Together, the x402 + AP2 + EigenCloud stack forms a complete verifiability layer, enabling secure, programmable interactions in the emerging agent economy.

👉 Deposit into Concrete’s Staked Eigen Vault and earn real yield today!

That’s it for today’s edition! See you soon.

Reply